Apps to improve your finances

Getting your finances together is not as easy as balancing your checkbook these days. Budgeting, paying off debt, paying bills on time and tracking expenses are just a few of the necessary evils required to stay on top of your financial game. These six apps, divided by type, can help you get your finances organized and stay that way.

Organizing your finances

Mint.com: The Mint.com app is one of the most popular choices for organizing your finances. A big perk to this app over others is that it is 100 percent free. The app's interface is attractive and user-friendly. It reports information about your checking, savings, credit cards and investment accounts in real time. Information can be graphically displayed for an at-a-glance look at where your money is going. Unfortunately, you can't update your accounts, budget or transactions with this app. You can only view the information. The app is available for iOS and Android devices.

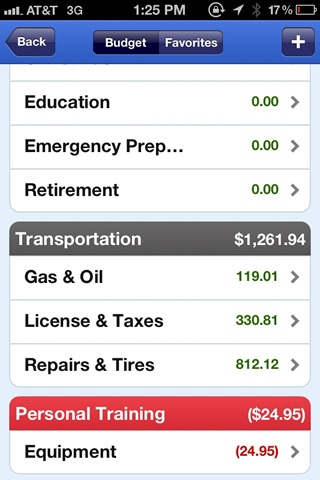

YNAB: The You Need a Budget (YNAB) app pretty much says it all. You need a budget. This is my preferred app for budgeting on-the-go. It supports cloud sync for real time syncing across all your devices. Multiple devices can be connected to the same budget so everyone in the house can keep up to date. Entering transactions is a breeze. This app is available for iOS, Android and Kindle Fire devices for $4.99. You must have an active subscription to YNAB 4 for Desktop to use the apps.

YNAB picture courtesy of You Need a Budget.

Paying bills on time

Bills Monitor: Bills monitor is my preferred application for due date reminders. The app features a calendar view of bills but has a list view as well. Bills can be added with categories, due date, amount due, pay from account, paid amount and notes. Bills can be recurring or one-time events. Bills can be paid in full or partial payments. Reminders are available in case you fail to look at your bill calendar. It also provides a handy feature to e-mail bills in CSV, HTML or PDF formats. Bills Monitor is free and available for iOS devices only. An upgraded, ad-free version is also available.

Bills Monitor picture courtesy of Maxwell Software.

PageOnce: This app allows you to view all your accounts in one central location. Accounts are added via the app which requires you to save your passwords. Users are able to see the date a payment is due, transactions on the account and monthly statements via the app. You can pay your bills through the app via checking account or credit card (a transaction fee applies when using a credit card). Reminders are sent for upcoming bills. Users are alerted to overage charges and suspicious transactions. This is another read-only app that doesn't allow direct entry of transactions. PageOnce is available for free on iOS, Android, Blackberry and Windows devices.

Reducing debt

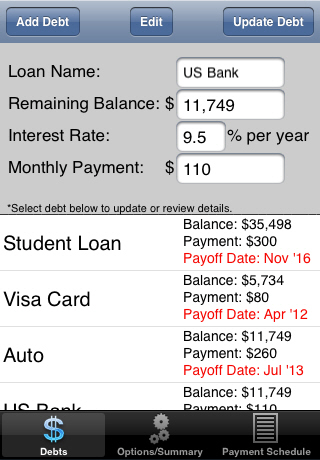

Debt Snowball Pro: Debt Snowball Pro is a highly recommended app to help users eliminate debt using the debt snowball method recommended by financial professionals like Dave Ramsey. The app is straightforward enough. Enter your debt information such as balance, interest rate and monthly payment. The app will help you choose the best way to pay off the debts. Once the debt is paid in full, the previous payment is added to the next debt. As bills are paid off, the amount applied to the next gets bigger and bigger, hence the 'snowball.' Users can choose to pay debts with higher interest rates first (this saves money in the end) or pay the smallest balances first (which many people find motivating). The app is available for iOS devices for $2.99.

Debt Snowball Pro picture courtesy of Matthew King Software.

Debt Payoff Planner: This app also utilizes the snowball debt reduction strategy. You start by entering debt balances, interest rates and minimum monthly payments. Choose whether you want to pay highest or lowest balances first, highest or lowest interest first, minimum payments only or in an order that you specify. Users also input the amount to pay toward each debt. Once all this information is entered, the app calculates a customized payment plan with an amortization table that describes how much interest you end up paying and when you'll be debt free. If you decide to make extra payments toward a debt, the app can accommodate that. The Debt Payoff Planner app is available for Android devices for $0.99.

What are some of your favorite money management apps? Share them with me in the comments.

Budget jar picture courtesy of Flickr user Tax Credits.

0 comments